You’ve generated leads who seem to be interested in your insurance products, but you can’t get them to the next step: buying a policy from you.

They either stop replying, or they don’t even reply after you’ve responded to their initial enquiry with the information they asked for. 🫥

Here’s a simple way to increase insurance sales from the leads you currently have: start tracking how they view the insurance brochures and PDFs you send them on WhatsApp, iMessage, email, and more.

By tracking how your leads interact with your insurance sales materials, you don’t have to guess whether they’re still interested or not – even when they don’t say anything!

Find out instantly when a specific lead views your files, and see how much time they spend considering your insurance offerings. With this information, you can follow up with them when they’re super interested and ready to hear what you offer – boosting your chances of securing a new client.

Overview

- Why should you start tracking views on your insurance brochures and sales materials?

- How to track lead interest through your insurance brochures and PDFs

- How to follow up with your insurance leads when they show interest

Why should you start tracking views on your insurance brochures and sales materials?

Your lead’s activity on your brochures indicates their interest level, which gives you an idea of when is the best time to follow up with them. When they open and browse a PDF file or link you sent them on WhatsApp or somewhere else, it’s safe to say that they’re interested in your offerings.

However, just because they’re looking at your brochure now doesn’t mean that they’re ready to buy an insurance policy immediately. They may go quiet for a while to consider the offer (which many salespeople mistake as the leads “ghosting” them).

But in the background, your leads may revisit your WhatsApp chats and files throughout the week as they find the time to think about it more. Being able to track this helps you.

The moment they start looking at your brochures again, you’ll know it’s the right time to follow up or send a quick check-in, even if they’ve not engaged with you for weeks or months.

When it comes to leads that aren’t ready to buy a policy on the spot, it’s the most accessible and attentive insurance agent who will win the sale. Keep following up based on the signals that show your lead’s interest level!

How to track lead interest through your brochures and PDF files

Things like WhatsApp “blue ticks” only tell you if a message has been seen (and your recipients can disable this feature at any time).

They don’t tell you how much time a lead has spent looking at your files, or whether they revisit them weeks or even months later.

Here’s how you can use Privyr to track content views and increase insurance sales – this technique works whether you use WhatsApp, email, or any other messaging apps to communicate with your potential clients.

You can upload and share content with your leads through the Privyr app, including your brochures, policy summaries, and other PDF files.

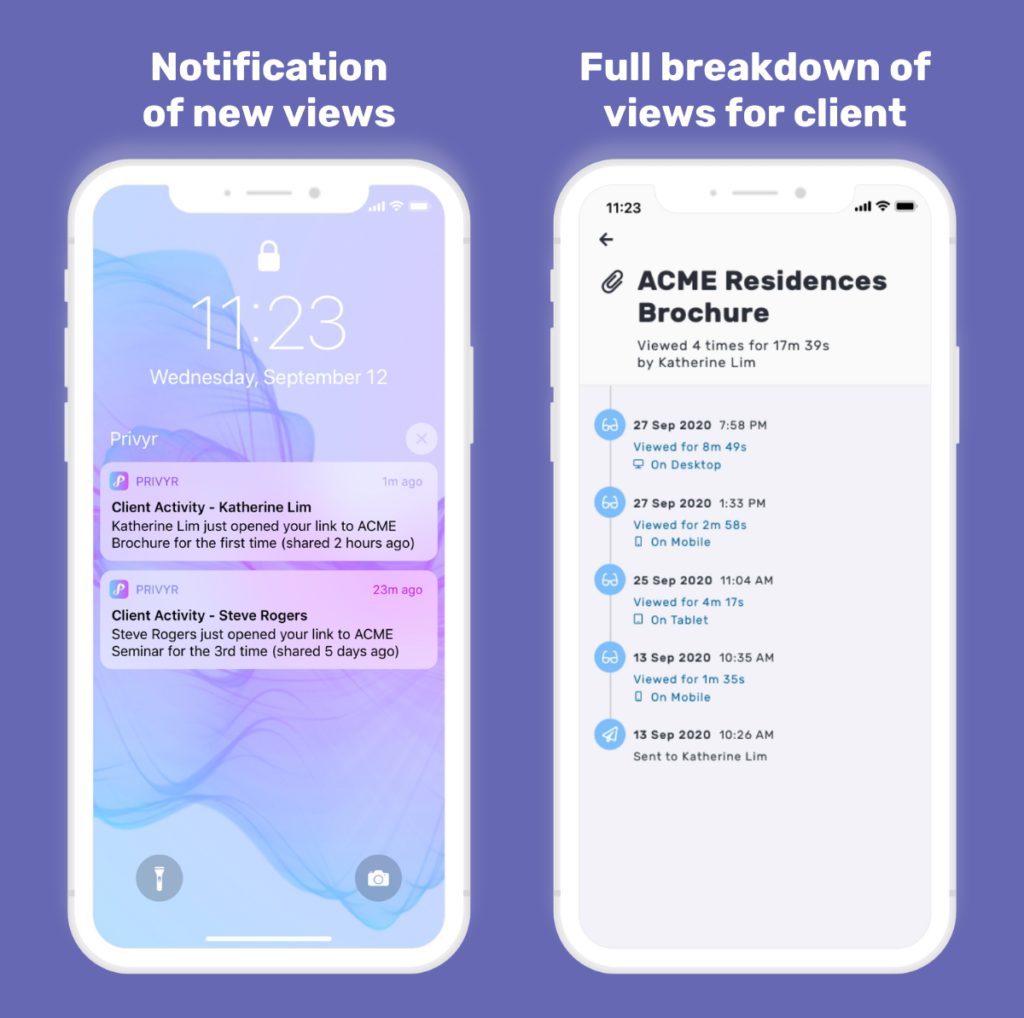

Privyr automatically tracks your leads’ activities on the Files you share with them via Privyr. You’ll receive instant notifications when a specific lead opens the File you sent them on WhatsApp. You can also check how many times they viewed it and how much time they spent looking at it.

To get started, go to the Content tab in the Privyr app (mobile or desktop), where you can either upload a PDF file you already have, OR create a Page in Privyr about the online course you want to promote.

Option 1: Upload a PDF file you already have to Privyr

This could be a brochure or a PDF file showcasing different insurance products your company offers. Under the Content tab, go to the Files section and upload the PDF file.

Your branding and contact information are automatically applied to the PDF file whenever you send it to a lead through Privyr. No matter how many times your File gets forwarded to other people, your branding will always stay intact, making it easy for other prospective clients to contact you.

Here’s a quick video tutorial on how you can track your PDF files on WhatsApp with Privyr to increase insurance sales.

Option 2: Create a Page in Privyr with links, images, videos, etc.

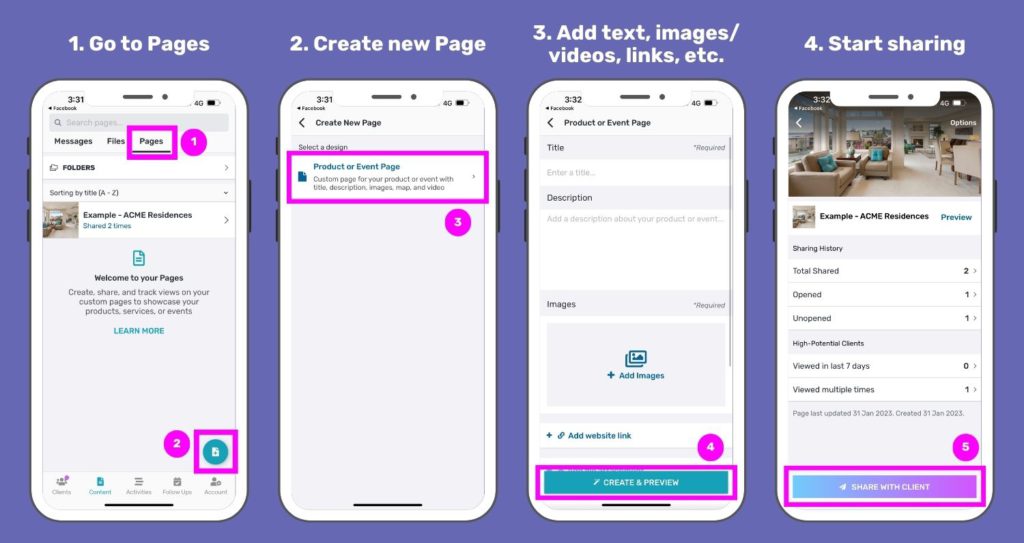

Don’t have a PDF file ready to go? You can easily create trackable Pages in the Privyr app to showcase your insurance products or promotions, and share them with your leads. Here are the steps:

- Under the Content tab, go to the Pages section.

- Click Product or Event Page.

- Start building your Page by adding a title, description, and images. You can also add website links, file attachments, YouTube videos, and Google Maps. Here’s an example of how your Page would appear to your recipients.

- Click Create & Preview once you’re satisfied with the Page you created.

- Now you can start sharing the Page with your leads.

Similar to Files on Privyr, your Pages will also have your branding and contact information, applied automatically. Doesn’t matter how many times the Page is forwarded!

How to follow up with insurance leads when they show interest

Once you know that a lead is actively viewing and revisiting your brochures, your next step is to follow up and help them move forward with their interest in your insurance products.

You want them to ask more questions or even meet up with you, so that you can give them more details and highlight the benefits of buying a policy from you.

However, remember that there are right and wrong ways to follow up. And one thing that you should avoid doing is over-personalising your follow up based on a lead’s activity on your files.

For example, if you see a lead viewing your brochure again after a long time, you SHOULD NOT call them up immediately to ask them if they’re interested right now.

The lead will be creeped out, and you’ll probably get blocked immediately. Here are better ways to follow up, while using the interest tracking feature in Privyr to your advantage.

Your follow-up should be relevant to the specific type of insurance policy your lead is showing interest in. However, it should never give the impression that you closely monitor what they do on the Files and Pages you share with them. Instead, you could design your message around the goals they may want to achieve by buying said policy.

Here are some scenarios and scripts you could use to successfully re-engage your insurance leads:

When you find that a potential client has opened your insurance promotion flyer a few times, without responding to your message:

“Hey Anthony 👋 Hope you had some time to look at our TripCare travel insurance promotion.

Just to recap, you’ll get a free designer luggage if you get an annual plan by the end of this month.

Let me know which countries you plan to visit this year and I can recommend you the best plan for you and your family?”

When a lead that has gone cold suddenly revisits the brochure you sent them months ago:

“Hey Asha, it’s Shannon from ACME Insurance here. Time sure flies!

The last time we spoke, you mentioned that you’re looking for a new medical insurance provider because the claims process at your previous provider was unsatisfactory.

If you’re still looking to switch to an insurance company with a top-notch claims system, do consider ACME. I’m happy to help. 🙂 May I send you the latest brochure for ACME GoodHealth Insurance?”

When a lead spends a lot of time looking at the life insurance comparison chart you’ve proposed to them, multiple times over a month, but doesn’t say anything:

“Hi Sam, hope you’re doing well! If you have additional questions about your LifeInsure coverage, maybe I can help. No policy is one-size fits all, after all. 🤭

I just need to know one thing: which of the following resonates with you?

1️⃣ Premium too high.

2️⃣ I want more coverage.

3️⃣ I don’t understand the policy.

4️⃣ I’m considering another insurance policy.

5️⃣ I want to know more about your claims process.

Just send me the number. 🙂”

Summary

When a lead doesn’t respond to you, it doesn’t mean they’re no longer interested. Most of them simply need more time to consider the offer, especially when dealing with insurance products.

To the average person, insurance is a long-term commitment that can be quite complex to understand – let alone buy – in one sitting. The most important thing you should do is send timely follow-ups that reduce the complexities and barriers to commitment.

Many insurance agents don’t know what’s going on in a lead’s mind since they don’t have a way to track how the person is interacting with their brochures, marketing flyers, and so on.

Consider sending your content to your leads through Privyr so that it becomes trackable. Tracking views on your Files and Pages gives you real-time insights into a lead’s buying journey, which you can then use to personalise your conversations with them.

When you know which leads have a continuous interest or renewed interest in your courses, you can follow up with them, before they go seek out other insurance alternatives.The result? Increased insurance sales, even from people you thought had lost interest a long time ago! Try Privyr’s Content Sharing and Tracking features today.