Insurance is a highly competitive industry. As an insurance agent, you’re well aware of the need to effectively manage your insurance leads. Chances are, these leads have already been approached by many of your competitors. Therefore, there’s a high chance of losing these potential clients if they aren’t managed correctly.

Excellent lead management plays a crucial role in taking your conversation with insurance leads to the next step. But how do you manage your insurance leads and close more deals?

In this article, we discuss how to manage insurance leads in the best way so you can increase your chances of converting them into customers.

How to manage insurance leads effectively

After you’ve successfully generated leads, the next step is to manage them well to increase your chances of closing the deal.

This involves employing a systematic approach to your follow-up, personalising communications, and leveraging data-driven insights to meet the specific needs and preferences of each lead.

Excellent lead management gives you a significant competitive advantage and plays a vital role in transforming initial interest to sales. Here’s a step-by-step guide to managing leads:

Step 1. Capture all your leads in one place

You’re probably generating leads through multiple channels, such as your website, social media, PPC campaigns or even traditional methods like billboards. This is a good strategy since different channels have their unique advantages. However, in the next step, it’s crucial to have a centralised system to manage all your leads in one place to ensure no lead slips through the cracks. Every lead is an opportunity that needs to be sufficiently nurtured.

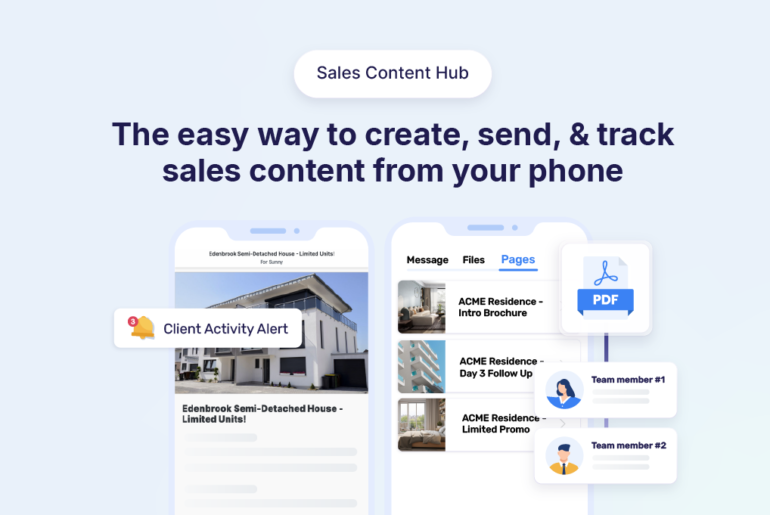

Managing all your leads in one place allows you to contact them swiftly, monitor the progress, and even assign them easily to your team members.

How to manage leads in one place

You can centralise the management of all your leads manually or through CRM software. Manual process involves exporting, importing, and updating your data inside spreadsheets. You’ll be entering, assigning and recording each lead manually. If you want to nurture your leads efficiently, a spreadsheet is usually not the right tool to handle your process. You’ll need a CRM in this case.

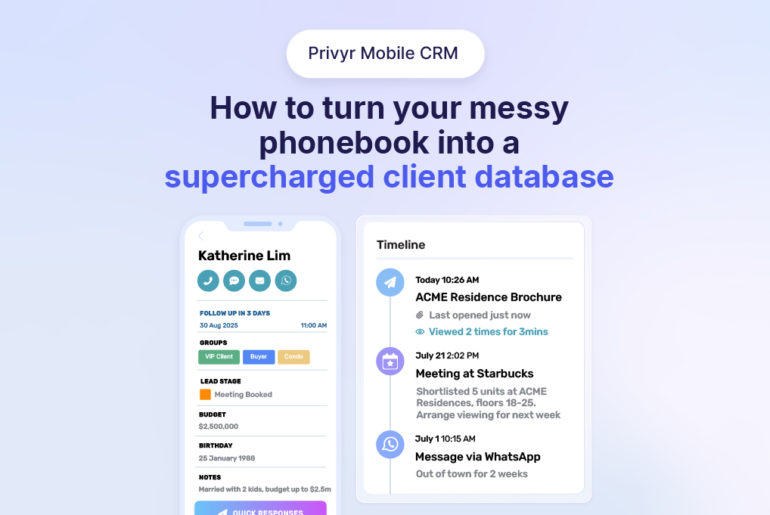

Most CRMs help you centralise lead management automatically, saving you a huge amount of time and effort. However, keep in mind that different CRMs are built for different purposes. For instance, CRMs like SalesForce and Hubspot are designed for larger enterprises whereas CRMs like Privyr are built to assist mobile-first small to medium businesses.

If you’re a mobile-first agent, here’s how you can use Privyr to centralise your lead management.

Step 1. Create a Privyr account and install the the app on your mobile

You’ll need to set up an account on Privyr to use it. Creating an account and importing leads from your lead sources is free on the app. Go to www.privyr.com and register. After signing up, install the app on your mobile device so you can enjoy a quicker, more streamlined sales process from your phone. Privyr is available on App Store and Playstore for iOS and Android devices.

Step 2. Integrate lead sources

Privyr integrates with major lead sources including:

- social media platforms like Facebook, TikTok, LinkedIn, and Instagram

- WordPress websites,

- Major forms such as WordPress Contact Form 7, WPforms, Ninja Forms, Gravity forms etc,

- And advertising platforms like Google Ads.

It also allows you to upload those leads that you generated offline (such as at networking events), so you can add them to your centralised sales process.

In the app, tap on Account and select Integrations.

You’ll see two options: 1) Lead Sources and 2)Import/Export Clients.

Under the first tab, you’ll find a list of Lead Sources that Privyr supports. Select your Lead source and tap on configure. You’ll be redirected to the lead source’s website or app where you’ll have to login and accept Privyr’s settings. Your lead source is now integrated into Privyr within a few taps.

To know more about Privyr integrations, refer to this detailed guide.

If you’re generating leads through traditional methods, such as phone calls, billboards or traditional advertising, go to the Import/Export Clients tab. Here, you’ll see options that allow you to import and export CSV lists.

By integrating Privyr with your online Lead Sources, all the leads that you generate are automatically synced to your mobile phone in real time. Since you can also upload leads manually, you have a centralised place to manage all your leads no matter how you collect them.

Privyr also facilitates easy distribution of leads across your team members. To set this up, tap on Clients from the menu and go to Teams. Here, you can invite your team members and customise the lead distribution process, so leads are distributed across your teams automatically and according to custom rules that you set.

Step 2. Personalise communications

As you’re well aware, insurance products can sometimes be complex and the decision-making process is often personal and/or emotional. That’s why personalised communication is so important in this case. It can play a significant role in enhancing client engagement and trust.

Personalising your approach highlights your commitment to client-centric service and builds trust, helping improve the likelihood of converting more leads into clients.

Here’s how to personalise your communications with your leads

Personalisation is all about designing your messages and interactions according to the unique needs and interests of individual leads or clients. Here’s a step-by-step guide to achieve it.

Step 1. Analyse the data

Analyse the information you have on your leads, such as their age, profession, family status, preferences, etc. You should already have most of this information while generating leads. This data can help you understand their needs, concerns, and what type coverage they may require.

Step 2. Segment your audience

After analysing the data, categorise your leads based on common characteristics. This enables you to create more targeted communication strategies. Plus, grouping your leads together can also help when you want to quickly send communications that are relevant to the entire group.

Step 3. Customise your messages

Now, it’s time to tailor your messages to address the unique concerns of each lead. For instance, a young family might be more interested in life insurance, while a business owner will likely prioritise liability coverage.

Step 4. Use the right communication channels

It’s really important that your leads receive your message and engage with it. The right communication channel plays a crucial role to ensure this happens. Therefore, identify which communication channel your leads prefer. For instance, business clients may prefer emails, while younger folks would just opt for a WhatsApp text. Some may prefer face-to-face meetings.

Addressing the person by name in a message is a common way to personalise it. However, you can go a step further and show empathy in your communication, ask questions to understand their situation better and even offer valuable and relevant information for the client’s needs. Here’s an example of a first outreach message:

“Hi Lauren, Thanks for exploring life insurance options with ACME. I’m Ken and I understand how important it is to find the right policy for your family’s security. I can offer policies tailored for your unique requirements starting at $45 per month. Can we set up a brief 5-min call to discuss your options? – Ken.”

Personalising communication is easier with Privyr. It helps you create personalised messages for your leads by automatically including their details (such as names) in the messages you compose. It’s really useful if you’re sending the same script to multiple people. If you want a next-level personalisation approach, it’s best to study your clients and compose message manually.

Step 3. Identify the best opportunities and prioritise them

Prioritising refers to identifying the leads that are most likely to convert and focusing on them more. By prioritising the right leads, you ensure high-potential leads receive adequate attention, enhancing their experience. This can significantly improve conversion rates.

Prioritising also ensures your sales process is efficient, and that you don’t focus too much time and efforts on leads that are less likely to convert. This is important since customers’ needs are specific in the insurance industry.

How to prioritise leads

Identifying the right opportunity can take several steps but the process begins with your first approach. Here are some tips:

Define qualified leads

First, it’s important to understand what you refer to as qualified leads. This could be based on demographics, engagement level, or specific interests. Once you define that, assign points to each criterion based on its importance. For example, a lead from a younger demographic might score higher when it comes to life insurance.

Analyse lead sources

The next step is to identify which of your lead sources are generating the most qualified leads. You may want to assign higher scores to leads coming from sources that historically convert better.

Assess lead engagement

After a few rounds of conversation, you can easily identify qualified leads based on their level of interest and engagement. This can be done by monitoring how leads interact with your messages. Identify leads that are actively viewing your message, responding to your questions, or requesting more information.

Consider buying signals

Leads showing urgency are typically more likely to convert. Also, enquiries about pricing or specific coverage details could hint that the lead is ready to buy a policy soon. Pay attention to such hints.

Don’t forget to consider additional factors such as the life stage of a lead and regulatory considerations. A lead’s life stage can be a significant indicator of their needs. Moreover, long-term relationships can be as valuable as immediate sales in insurance. Consider the long-term potential of leads as well.

Prioritising leads is much easier with CRMs. With the data they produce, you can easily identify leads that are more likely to convert. If you’re a mobile-first agent, Privyr can help you prioritise leads with ease. For example, you can use the client grouping feature to sort your leads based on their readiness to buy. It keeps track of all your conversations and allows you to identify high-value leads backed by the data.

Step 4. Follow up and nurture

Consistent follow-up and nurture help you build and maintain great relationships with your leads. In the insurance business, decisions are often based on trust and reliability. Therefore, repeated interactions play a crucial role in establishing a bond with your leads. Regular follow-ups keep your leads engaged with you, reminding them that you are there to address their needs.

Moreover, each interaction is an opportunity to learn more about the lead and gain valuable information for personalising your communication later. However, nurturing leads shouldn’t just be about converting them right away. It can also start off your long-term relationship with a future client.

Here are some tips to implement effective follow-up and nurture:

- Develop a follow-up plan: Create a follow up plan that adapts to the lead’s responses and engagement level. For instance, set initial follow-up within 12 hours followed by weekly or bi-weekly check-ins.

- Provide value in each interaction: Every follow-up should offer value. This could be educational content, market updates, or answers to previously asked questions. While doing so, keep in mind that it’s really important to avoid making every communication a sales pitch. Aim to build a long-term relationship, not just to sell.

- Use multiple communication channels: Communicate with the leads based on their preferences. For instance, some leads prefer phone calls after a few rounds of text messages while some like to communicate via emails. However, be mindful to not overwhelm the lead.

- Monitor responses: Analyse how leads respond to your follow-ups and refine your approach over time. Adjust the frequency and nature of your communications based on lead engagement.

- Regularly review and adjust strategies: Monitor how effective your follow-up and nurturing strategies are and adjust your tactics based on what works best.

A CRM like Privyr can help you track all your interactions with your leads and clients. It even automates reminders for follow-ups, ensuring no lead is neglected.

Conclusion

Managing insurance leads effectively requires more than just good organisational skills. It should also focus on strategic relationship building. As customer preferences are changing rapidly, be sure to keep an eye on emerging trends and technologies that can enhance your approach.

Additionally, continuous learning ensures you stay adept at handling the evolving client expectations and standing out in a competitive field. Keep in mind that an empathetic approach is the key element in building long-term lead relationships in the insurance business.