Qualifying for MDRT in India is considered a global benchmark of excellence in insurance sales and financial services. It’s a prestigious achievement as only a small percentage of agents achieve MDRT status.

If you’re a life insurance agent based in India aiming for MDRT, we’re here to help you get started. This guide will help you follow all the right steps to complete your MDRT documentation.

Here’s everything you need to know about MDRT and how to qualify for it in India, step by step.

What is MDRT

Million Dollar Round Table (MDRT) is an international organisation that recognises leading insurance agents and financial advisors from around the world who meet high performance criteria. The criteria is typically based on sales performance (commissions, income, or premiums) within a calendar year, along with adherence to strong ethical and professional standards.

In India, MDRT qualification is a major achievement for life insurance agents. MDRT status signals that an agent is among the top performers globally and locally in terms of insurance sales, client service, and professional excellence.

MDRT Levels explained

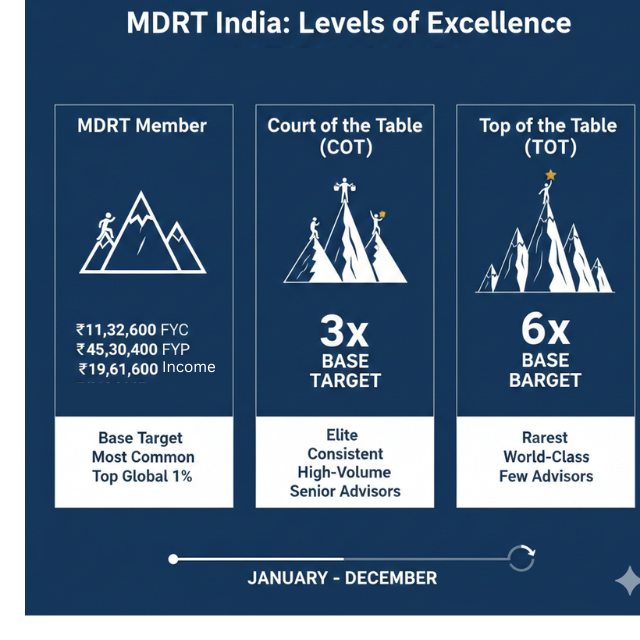

MDRT recognises life insurance professionals in India based on annual production performance. There are three distinct levels of achievement to this recognition.

MDRT Member (Base Level)

MDRT membership is the entry point and the most common level of MDRT qualification. Achieving this membership means the insurance professional has met the global MDRT minimum production requirement within a single calendar year (January to December).

To achieve this recognition, life insurance professionals should meet the minimum MDRT production target in a calendar year based on: first-year commission (FYC), or first-year premium (FYP), or income.

Most MDRT qualifiers in India fall into this category. This recognition would already place an agent among the top-performing agents globally.

Court of the Table (COT)

Court of the Table is a more elite MDRT level that is achieved when an insurance professional meets approximately three times the base MDRT target. This achievement recognizes consistent, high-volume performers.

In India, significantly fewer advisors reach COT, which is mostly achieved by senior advisors with strong referral networks.

Top of the Table (TOT)

Top of the Table is the highest and rarest MDRT level. The requirement to achieve this recognition is to bring in six times the base MDRT target. This level represents exceptional, world-class performance.

In India, it’s extremely rare, often limited to a handful of advisors per company per year.

Who can qualify for MDRT in India

In India, MDRT qualification is practically limited to life insurance professionals. This is because MDRT eligibility is based on first-year life insurance production and requires nomination by a life insurance company. Which is why LIC agents and individual agents of private life insurers make up the vast majority of MDRT members in India.

Financial advisors or wealth managers may also qualify for MDRT only if a significant portion of their income comes from life insurance and their production is routed through a recognised life insurer that can nominate them. Advisors who focus primarily on mutual funds, general insurance, or fee-only financial planning typically do not qualify as these income streams do not meet MDRT’s criteria.

Steps-by-step guide to qualify for MDRT in India

To qualify for Million Dollar Round Table (MDRT) in India, you need to follow a structured process based on annual production, ethical conduct, and company nomination.

If your target is to achieve this feat this year, here’s a detailed breakdown of each step involved.

Step 1: Be an eligible life insurance agent

The first step to qualify for MDRT in India is to meet the basic eligibility criteria.

Basic requirements:

- You must be a registered and active life insurance agent.

- You must hold a valid IRDAI license.

- You must be associated with an approved life insurance company, such as LIC India, or a private life insurer (e.g. HDFC Life, ICICI Prudential, Tata AIA, SBI Life, Max Life).

Keep in mind that MDRT qualification is strictly year-bound and the qualification year runs from 1 January to 31 December. Therefore, only new eligible business conducted within the calendar year is considered for MDRT for that calendar year. Business written outside this period does not count, even if the policy is later issued.

Step 2: Achieve the MDRT production target

The next step is to meet any one of the MDRT-approved production criteria for the calendar year.

Listed below are three India-specific MDRT qualification criteria. You do not need to fulfill all of them — just one is sufficient for your application.

1. First-Year Commission (FYC)

- Earn a minimum of INR 1,132,600 in eligible first-year commission. Just be aware that only commissions earned from newly issued life insurance policies are counted.

2. First-Year Premium (FYP)

- Achieve a minimum of INR 4,530,400 in total first-year premium. Only premiums from new life insurance policies are counted.

3. Income

- Earn INR 1,961,600 in eligible income from insurance sales. This method is less commonly used in India and may depend on your company structure.

Always confirm the official MDRT targets for the year with your insurance company, as figures may be updated annually. Also, product eligibility and calculation methods may vary slightly by insurer.

Step 3: Count only eligible insurance business

As mentioned in the second step, not all insurance sales qualify for MDRT calculations. Companies apply MDRT-approved rules to determine what counts.

Generally eligible businesses include new life insurance policies, term insurance plans, traditional savings and protection plans (e.g. endowment, whole life).

Unit Linked Insurance Plans (ULIPs) can be partially eligible but only a portion of the premium or commission may be counted. Additionally, eligibility may also depend on company-specific MDRT rules.

Renewal premiums, non-life insurance products, ineligible riders, bonuses, or non-qualifying incentives are not eligible.

Always work with your insurance company to identify eligible businesses as it calculates MDRT eligibility after applying all exclusions.

Step 4: Maintain ethical and compliance standards

Meeting the production target is the minimum requirement but not sufficient to qualify for MDRT alone.

You must also ensure that you’re following ethical selling practices, conducting proper needs analysis and disclosures, and maintaining acceptable policy persistence.

Your insurance company can withhold your MDRT nomination if serious compliance or ethical issues arise. This can happen even if you have met the production target. MDRT places strong emphasis on professional integrity and client trust.

Pro tip: Avoid mis-selling, policy cancellations, and unresolved client complaints. Ensure complete and accurate documentation.

Step 5: Get nominated by your insurance company

Insurance agents and advisors do not apply directly to MDRT. Your insurance company verifies your production, ethical compliance, and submits your nomination to MDRT. MDRT would then review the submission and confirm your membership.

Once approved, you’re officially recognised as an MDRT Member for that year.

Step 6: Renew qualification every year

As you may already know, MDRT membership is valid for one calendar year only, so you must re-qualify every year by meeting the new year’s targets. Basically, you’ll be following the same steps for the next year. If you’ve met criteria for a higher tier MDRT membership, you can apply for that.

Just keep in mind past MDRT status does not guarantee future membership and each year is assessed independently for production and compliance. Consistency is what separates one-time MDRT qualifiers from long-term MDRT professionals.

MDRT Preparation Checklist: LIC Agents

1. Eligibility and Setup

2. Target and Planning

3. Eligible Business

4. Sales and Documentation

5. Policy Issuance and Persistency

6. Compliance and Ethics

7. Nomination and Approval

MDRT Preparation Checklist: Private Agents

1. Eligibility and Setup

2. Target and Planning

3. Eligible Business (Private)

4. Sales Quality and Suitability

5. Policy Issuance and Persistency

6. Compliance and Ethics

7. Nomination and MDRT Approval

Use Privyr to grow your business and qualify for MDRT in India

If you’re aiming to qualify for MDRT this year, you need a smart tool to streamline your follow-up process, reduce manual effort, and free up your time to focus on what matters most — closing more sales. Relying on manual processes can be time-consuming and inefficient, especially when you’re trying to build a consistent pipeline, follow up effectively, and track MDRT-eligible production accurately.

This is where Privyr comes in. Privyr is a lead management system designed to help you grow your business. It eliminates the need to download, track, and check for new leads across multiple platforms, ensuring no opportunity slips through the cracks. As Privyr takes care of your repetitive tasks, you can spend more time engaging prospects in one click, automatically nurture relationships using long-term sequences, and drive the sales performance needed to achieve MDRT.

Privyr allows you to:

Build and manage a strong prospect pipeline by

- Automatically capturing every lead from ads, referrals, walk-ins, events, and more

- Segmenting leads by income, life stage, or product interest

- Tracking where each prospect is in the sales journey

Improve follow-ups and conversions by

- Automatically setting reminders for calls and meetings

- Tracking conversation history with each client

- Automating follow-up sequences for undecided prospects

Track MDRT-eligible production in real time by

- Recording issued policies vs proposals

- Separating eligible from non-eligible business

- Monitoring first-year premium and commission

- Comparing monthly performance against MDRT targets

Strengthen persistency and compliance by

- Tracking premium payment status

- Setting renewal reminders

- Recording client communications and disclosures

- Flagging policies at risk of lapse

Build a referral-driven MDRT business by

- Identifying satisfied clients ready for referrals

- Tracking referral sources and outcomes

- Helping you follow up with referrers automatically

Sounds interesting? Click here and try Privyr for free today!